Also if you are not an auto owner, you will be required to submit an SR-22 for non-owner status. sr22 insurance. In Illinois, SR-22 insurance coverage is needed for three constant years.

If you move out of the state of Illinois you have the ability to forgo your responsibility of filing an SR-22 in the state of Illinois by filing a testimony, however, it is extremely likely that you will certainly need to acquire SR-22 insurance coverage in the new state. There are really couple of options to SR-22 insurance as the state has flagged you as an at-risk driver, as a result, the alternatives are unusual and pricey. car insurance.

Conversely, you might deposit a guaranty or property bond – credit score. For more details browse through the Secretary of State site.

Insurance provider may consider their policy costs the driving record of any individual of driving age that lives within an insured's home. If you have any questions concerning the possible impact a recently accredited chauffeur might have on your plan, you might wish to contact your insurance coverage representative. It expires with your registration as well as needs to be paid at renewal.

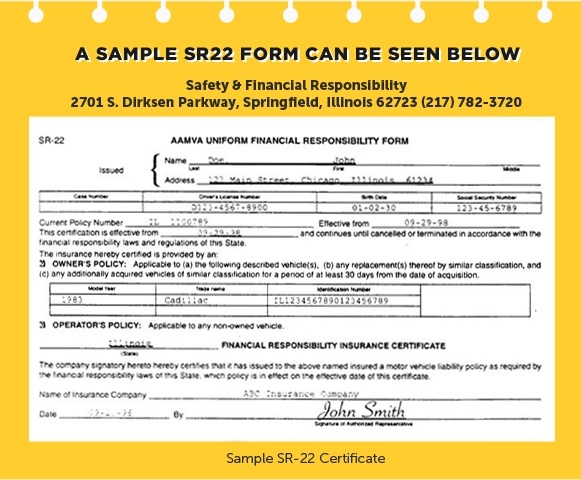

SR22 is a state declaring that is required for motorists that have actually shed their driving advantages. To restore your driving privileges, you need to understand exactly what SR22 insurance coverage is and how you can get it. auto insurance. What Is SR22 Insurance? SR22 isn't actually a sort of insurance coverage it's a form that your insurance coverage supplier have to fill in and file as proof to the government that you're appropriately insured, so your driver's certificate can be renewed.

All About Florida's Sr22 Insurance Agency

You may likewise see it written as SR-22 insurance or an SR-22 form. Of training course, your insurance supplier need to be willing and also able to submit this documents with the state to inform them that you have insurance coverage, however not every insurance policy provider provides SR22 declaring with their insurance coverage policies.

This is since the state needs to know that you continue to be in excellent standing with your insurance provider which you are keeping the state-mandated quantity of insurance in any way times (sr22 insurance). With this filing, your insurance coverage company is notifying the state that you are monetarily accountable and keeping coverage for any type of mishaps.

That Requirements SR22 Insurance? Exactly how do you understand if you or someone you recognize requirements SR22 insurance?

vehicle insurance insurance coverage deductibles liability insurance car insurance

vehicle insurance insurance coverage deductibles liability insurance car insurance

SR22 insurance for reckless driving: The state will call for SR22 filing if you have a major moving offense conviction on your record, such as irresponsible or negligent driving. SR22 for put on hold permit: If your certificate is suspended, such as for driving without insurance coverage or for getting numerous website traffic tickets in a short time, after that the state will certainly need SR22 filing.

If you fall short to carry the appropriate amount of insurance policy coverage in Missouri, your license might be put on hold, and you'll be required to submit an SR22. If you want to get back to driving as well as the state needs that you submit an SR22 form, this is a step that can not be missed – car insurance.

The Sr-22 Insurance- What Is It And How Does It Work? – Geico PDFs

Are SR22 Insurance and SR22 Certifications the Exact Same? Part of the confusion bordering SR22 insurance is the several terms that insurance business as well as states utilize to explain the exact same point.

Where the FR44 differs is in its responsibility limit requirements, which are normally dual the state minimum. If the minimal responsibility restriction in a state is $25,000 per person, the demand with an FR44 would certainly be $50,000 per individual.

The only way you can get an SR22 type is by purchasing a cars and truck insurance coverage with an insurer. An SR22 can not be gotten in any other method. insurance. Luckily, purchasing an auto insurance coverage that consists of filing an SR22 certificate isn't complicated or at the very least, it should not be with the best insurance coverage provider.

Just call your insurance policy agent to make this demand, and also ask that they submit an SR22 in your place (sr-22). Considering that many insurer do not submit SR22 as well as don't intend to guarantee a chauffeur who has a major driving infraction on their document, you may desire or require to compare auto insurance quotes from various companies.

SR22 Insurance for a New Plan Depending Upon just how you're buying your policy, you can make the selection for this plan online or tell your insurance coverage agent what you're trying to find. Your insurance policy service provider need to after that handle the remainder of the procedure. When purchasing insurance coverage that consists of SR22 declaring, you may wish to deal directly with your representative, as the process may move a little faster and you ought to be able to get a more precise rate.

3 Simple Techniques For How Long Do You Need Sr22 Insurance In … – Pocketsense

You might not know what the cost is until you have actually currently purchased the plan (insurance coverage). To make sure you're getting the very best insurance solution, you may want to consult with an insurance policy agent that has experience working with high-risk vehicle drivers and can obtain you the protection options you look for.

You'll be called for to acquire the same responsibility restrictions from your key plan on your SR22 plan – insure. Some drivers may not desire to lose their key insurance company. This may be because they're obtaining superb price cuts, or they have bundled coverage with this supplier. Buying a separate non-owner insurance policy to satisfy the SR22 need may be the best option for them.

ignition interlock division of motor vehicles bureau of motor vehicles vehicle insurance vehicle insurance

ignition interlock division of motor vehicles bureau of motor vehicles vehicle insurance vehicle insurance

Depending on the state, you'll just require SR22 insurance coverage for one to 5 years. Just how Long You'll Require to Bring SR22 Insurance coverage The size of time you'll need SR22 insurance might also rely on the infraction – sr22 coverage. Three years is the normally called for length of time that you'll require to have SR22 insurance coverage as long as you don't have any type of significant offenses throughout that timeframe.

insurance division of motor vehicles sr22 insurance division of motor vehicles

insurance division of motor vehicles sr22 insurance division of motor vehicles

One example is the FR44. In states like Virginia and Florida, the FR44 is required in place of the SR22. To obtain an FR44, you have to carry insurance coverage that completes two times the minimum liability limitation of that state. When you have an SR22 in one state and also transfer to a different state, you'll likely still be required to carry SR22 insurance policy in the state where you committed the infraction.

The Expense of Discovering an Insurance Service Provider That Supplies SR22 Insurance A lot of insurance coverage carriers have the capacity to sell SR22 insurance, but some like not to. insurance. Depending on the company, you may get averted or just get no feedback to your demand. Drivers who locate themselves in this scenario should rather seek an insurance provider that uses risky auto insurance.

Sr-22 Car Insurance In California – Quotewizard Can Be Fun For Everyone

2. The Expense of Driving Violations When you locate an insurance policy service provider that agrees to function with you, what can you anticipate in terms of price for SR22 insurance policy? With lots of insurance companies, purchasing an auto insurance coverage plan with SR22 declaring can be costly, though the high expense is normally due to the fact that of your driving violation instead of due to the state declaring fee.

Risky chauffeurs pay even more for insurance than chauffeurs that do not have any infractions on their documents since an insurance policy company currently sees you as a liability. Significant violations as well as violations that result in the demand of an SR22 are substantially trek up a motorist's insurance policy price. A single DUI sentence can increase your rate substantially – bureau of motor vehicles.

In Missouri, the following are price quotes for rises you can expect on your typical annual rate after particular infractions: A DUI sentence: If you're captured driving intoxicated, this sentence might enhance your typical annual insurance price. An at-fault crash: If you are established to be liable for a mishap, this offense can result in an increase in your typical yearly insurance price.

Luckily, you will not need to pay this penalty permanently. As long as you remain insured and also maintain your document clean, you'll be paying typical car insurance policy rates in a couple of short years. 3. The Fee for SR22 Insurance policy The cost of the state declaring cost depends upon the state. In Missouri, for an Electric Motor Car Crash Judgement, the fee to renew is $20.

Non-Resident Lawbreaker Compact Suspension Demands Nonresident violator compact is the name of the regulation that makes certain equivalent therapy of non-residents and also locals. When a vehicle driver is quit and issued a citation by police, the policeman can let the vehicle driver continue his/her way without needing the driver to upload bond.

Little Known Questions About Sr22 Insurance In Olympia & Centralia, Wa.

It must be completed in complete and confirmed by your insurance coverage agent or insurer. sr22 coverage. Do not send your insurance coverage. Submit security in the type of a licensed check (no personal checks), or a deposit slip, duly designated to the Division in the quantity listed in the letter.

The launch should have the day of the mishap as well as the names of all parties involved. Send a notarized conditional launch of obligation signed on your own and also the various other event(s) or their insurance policy business indicating that you are making payments for problems as a result of this crash. The conditional release needs to consist of the day of the crash as well as the names of all the events involved.

KEEP IN MIND: Never ever send out cash via the mail. bureau of motor vehicles. You will certainly need to call an insurance company accredited to compose plans in the State of Wyoming and also pay for an SR22. SR22 is a type notifying this Department that the driver with the demand has a valid insurance coverage. The SR22 is typically sent to Chauffeur Services electronically within 24 72 hrs after purchase.

Please note: you may still owe a reinstatement fee! Citations are paid to the court, for court get in touch with information visit the Wyoming Judicial Branch web site.

sr22 insurance coverage deductibles ignition interlock insurance

sr22 insurance coverage deductibles ignition interlock insurance

Does Nevada allow Proof of Insurance policy to be provided on a mobile phone? Yes. Evidence of Insurance coverage might be provided on a printed card or in an Click for more electronic format to be presented on a mobile electronic device. Insurance firms are not called for to give electronic proof. However, they should constantly give a published card upon request.

A Biased View of How Long Do I Need An Sr-22? – Bluefire Insuranc

This will likewise tell you whether your car registration is active and its expiration date. Why did I receive a verification letter? Was I randomly chosen? Insurance Verification Notifications are never arbitrary. Notices mean we do not have a valid record of your responsibility insurance policy protection or that there is a possible gap in the coverage.

Typically, this takes place when you change insurance provider. You can upgrade your insurance policy online. There are no grace periods. How do I react to the letter? There is no requirement to visit a DMV office. You may reply online or by mail – sr-22 insurance. The initial choice is to finish your feedback online using the offered accessibility code printed on your letter.