You call your insurance carrier, and also they should issue you the type when you have purchased the minimum amount of car insurance coverage. You'll need to preserve the minimum amount of insurance coverage as well as make certain you have an existing SR22 type for the duration established by the state you reside in (liability insurance).

The SR22 can set you back regarding $25 in declaring fees. SR22 may lead to a boost in insurance policy prices by in between 20% and also 30%. An SR22 issued for without insurance driving is around $30 as well as can depend upon your credit (division of motor vehicles).

If you do not have an auto however have to file an SR22 due to a conviction, you'll need to ask your agent regarding a non-owner policy. These policies cover your driving when you drive another person's lorry or a rental as well as cost much less than guaranteeing an auto. motor vehicle safety. If you switch over insurance provider while you have an SR22, you'll need to apply for a new SR22 before the initial strategy ends.

This form tells the state concerning the adjustment. Getting the declaring removed might reduce your prices on your insurance. Just how Do I Discover Out if I Still Required SR22 Insurance Policy?

In some states, if you cancel your SR22 declaring early, you might be called for to reactivate the period over once more, even if you were just a few days from the day it was readied to end (motor vehicle safety).

Some Known Incorrect Statements About Do You Need An Sr-22 To Reinstate Your License?

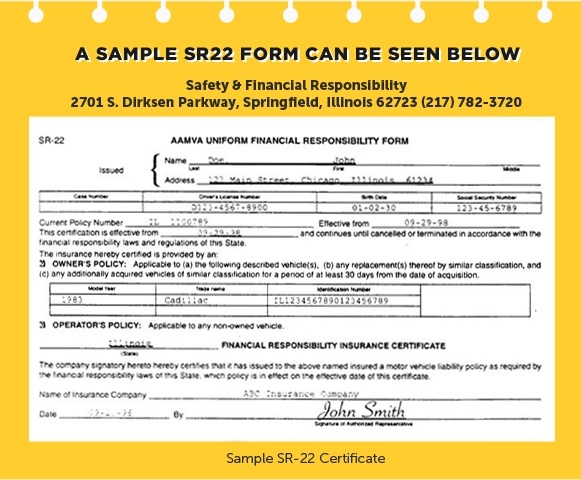

An SR-22 is a certification of monetary responsibility required for some chauffeurs by their state or court order – liability insurance. An SR-22 is not a real "kind" of insurance, but a kind submitted with your state.

insurance companies auto insurance underinsured auto insurance department of motor vehicles

insurance companies auto insurance underinsured auto insurance department of motor vehicles

Not every person requires an SR-22/ FR-44.: DUI convictions Careless driving Crashes created by uninsured chauffeurs If you require an SR-22/ FR-44, the courts or your state Electric motor Car Department will inform you.

Is there a cost associated with an SR-22/ FR-44? This is an one-time cost you should pay when we submit the SR-22/ FR-44.

A filing fee is charged for each and every private SR-22/ FR-44 we file. For instance, if your partner gets on your policy and both of you need an SR-22/ FR-44, then the declaring fee will be charged twice. Please note: The cost is not consisted of in the rate quote since the filing cost can vary.

How much time is the SR-22/ FR-44 legitimate? Your SR-22/ FR-44 should stand as long as your insurance plan is active. If your insurance plan is terminated while you're still called for to bring an SR-22/ FR-44, we are required to alert the proper state authorities. If you do not maintain continuous protection you might shed your driving benefits.

Getting The Best Cheap Sr-22 Insurance Rates In California To Work

A Tennessee SR22 can be required for an overall of 5 years from your date of suspension. If the Tennessee SR22 is applied for a total amount of 3 years (36 months) within the 5-year period, the SR-22 may be terminated provided it is not needed on any kind of other suspension. If 5 years pass from the day of suspension before you renew your privileges, then the Tennessee SR22 would certainly not be needed. sr-22 insurance.

The SR-22 demand begins on the day of the conviction. You are the owner of a lorry that was uninsured at the time of a mishap. The SR-22 requirement starts on the date of the accident. You are trying to renew your driving advantages. The SR-22 requirement starts on completion date of the suspension.

The SR-22 requirement starts when you use for the authorization and also ends when the authorization ends. Please get in touch with DMV to see if you need to get an SR-22. Out of State Declaring, Also if you live out of state, you should file an SR 22 with Oregon (if needed) prior to an additional state can provide you a chauffeur permit.

Any type of Colorado local who has actually had their driver's license withdrawed for driving intoxicated is needed by the Department of Earnings, Department of Electric Motor Cars (DMV) to acquire "Evidence of Insurance" prior to reinstatement of their driving benefits. This kind of insurance policy, called an SR-22, requires the insurance coverage service provider to report any gap in insurance coverage to the Colorado Electric Motor Lorry Department.

Your SR-22 will certainly expire when you have effectively met that time period. If you enable your policy to gap or you terminate it, your vehicle insurance provider is needed to alert the state instantly as well as your certificate will be withdrawed or suspended once again. What occurs if I transfer to another state? SR-22s are state particular.

The 8-Minute Rule for 10 Things You Need To Know About Insurance Form Sr-22 …

If you currently bring an SR-22 and also relocate to a state that that does not require an SR-22, you still must appropriately fulfill the requirements of the SR-22 in the state it was originally released in (driver's license). Additionally, your new insurance policy must have liability limits which satisfy the minimums called for by legislation in your previous state.

Just how do I acquire SR-22? You need to call your insurance policy service provider to acquire an SR-22 (insurance group). If your insurance policy company does not use SR-22 or is mosting likely to terminate your coverage due to this demand, you can call Sarah or Dane Hamilton at HL Insurance Policy Group at (720) 343-7459, as they use SR-22 as well as all of your various other insurance coverage needs at competitive prices.

sr-22 division of motor vehicles division of motor vehicles insure vehicle insurance

sr-22 division of motor vehicles division of motor vehicles insure vehicle insurance

You need to contact your insurer and also several other insurer to acquire a quote. SR-22 is relatively cost-effective; however, SR-22 is a red flag to your insurance coverage supplier that you have issues with your driving background as well as are currently a high threat loss. Requesting and getting SR-22 allows your insurer know something is happening with your driving background and urges the insurer to investigate better into why you are being required to have an SR-22 – insurance companies.

This information is what creates the insurer to dramatically raise your prices as they now classify you as high danger (deductibles).

Chauffeurs who are founded guilty of particular significant driving offenses in Arizona have to ask for an SR-22 insurance document in order to reinstate their licenses after they were put on hold. This kind certifies to the Arizona MVD that you are pleasing the state requirements for liability insurance policy. driver's license. While the SR-22 paper itself just costs a modest cost, drivers that require an SR-22 pay concerning 40% more for insurance policy than other drivers.

The Best Strategy To Use For Best Cheap Sr-22 Insurance Rates In California

If you currently have energetic insurance coverage, you might be able to call your current insurer as well as ask to include an SR-22, which it will certainly send out to the AZ MVD. However, you might require to obtain a brand-new insurance coverage, as numerous insurer will certainly terminate your insurance coverage after finding out about your new SR-22 requirement.

It's a good suggestion to talk to several to locate a more affordable rate. When collecting quotes, be sincere about your situation as well as answer concerns associating to your conviction. Some insurers explicitly ask whether you need an SR-22, while others just ask about the situations that would certainly lead to needing one. insurance.

Once you have actually gotten to the three-year threshold, double-check with the AZ MVD that you are no longer needed to carry the policy. Call your insurance policy firm to cancel the SR-22. You must have the SR-22 on declare 3 continuous years not just the three-year period after your permit was withdrawed.

USAA's prices increased by 166% for a motorist that needs an SR-22. Our list of insurance firms below contrasts the ordinary annual prices for a 30-year-old male with as well as without an SR-22 declaring and also DUI sentence. You ought to always contrast multiple quotes between insurance coverage companies to ensure you are picking the most effective choice.

car insurance insurance companies dui deductibles insurance companies

car insurance insurance companies dui deductibles insurance companies

The file validates you have actually acquired insurance protection; your insurance firm is additionally required to notify the Arizona MVD if your insurance coverage is canceled (liability insurance). If you have an SR-22 filed with the state, you're often referred to as having "SR-22 insurance coverage," even though it's not technically a different kind of insurance.

Examine This Report on Facts About Sr-22 Insurance In Washington – Milios Defense

driver's license insurance coverage driver's license sr22 insurance bureau of motor vehicles

driver's license insurance coverage driver's license sr22 insurance bureau of motor vehicles

These offenses both normally cause a permit suspension or retraction, and you'll need to obtain an SR-22 in order to have your certificate renewed. deductibles. However, a court might choose to call for that https://report-sr-22-insurance-what-is-it-how-work.fra1.digitaloceanspaces.com you obtain an SR-22 in various other situations as well, such as if you have a lot of factors on your license or have a lot of unsettled tickets.

In this instance, you'll require to acquire SR-22 insurance. Nonowner insurance coverage is normally cheaper than normal vehicle insurance policy because it does not consist of coverage for an automobile. car insurance. It's likewise more affordable due to the fact that it presumes you will certainly not drive as commonly as a person who has an automobile and drives it regularly.